Due diligence in the context of AML (Anti-Money Laundering) refers to the set of processes, checks, and assessments that financial institutions and other regulated businesses perform to verify the identity of customers, assess their associated risks, and monitor ongoing relationships to detect and prevent financial crime.

It matters because without effective due diligence, criminals can more easily use financial systems to launder money, finance terrorism, commit fraud or evade sanctions. Regulators demand due diligence as a central pillar of AML compliance; failure to perform it properly can lead to legal penalties, reputational harm, and regulatory sanctions.

Due Diligence Definition And Key Components

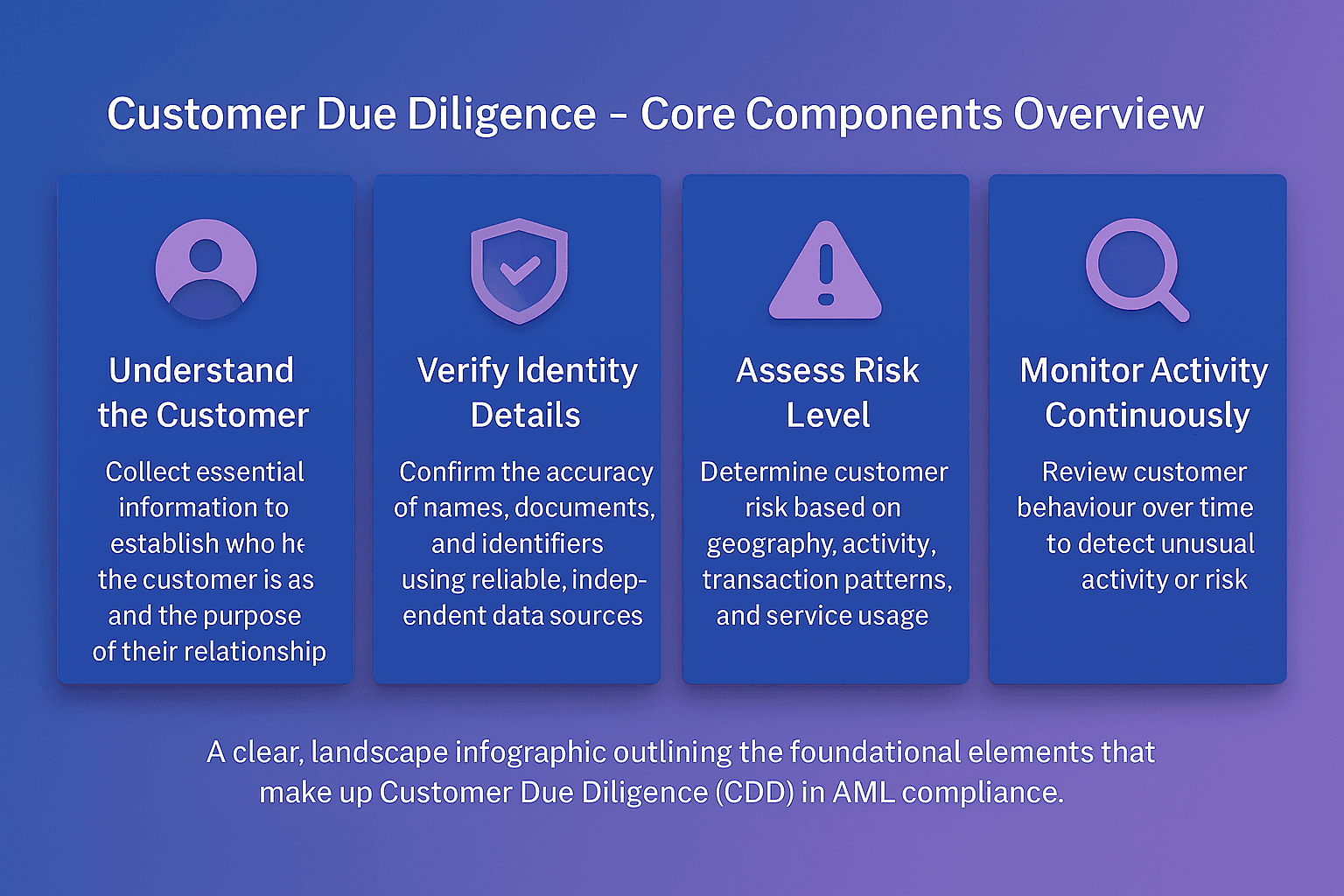

Due diligence is more than just verifying identity; it covers multiple layers and stages to ensure that a business relationship is legitimate and low risk, or if high risk, appropriately managed.

Key components include:

Customer Identification: Verifying who the customer is, e.g. through government IDs, proof of address, registration documents for legal entities.

Beneficial Ownership: For legal entities (companies, trusts etc.), identifying who ultimately controls or benefits (UBOs) to uncover hidden risk.

Risk Assessment: Evaluating risk factors such as geographic risk, customer risk (e.g. PEPs - Politically Exposed Persons), product or service risk, and transaction channels.

Enhanced Due Diligence (EDD): Applying more stringent measures when risk is elevated.

Ongoing Monitoring: Continuously reviewing transactions and other customer information to detect changes in behaviour, anomalies, or risk levels.

Legal And Regulatory Frameworks For Due Diligence

Due diligence is required under multiple laws and regulations, both internationally and in specific jurisdictions.

UK Laws And Regulations

The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLRs) require customer due diligence (CDD) measures. These include verifying identity, assessing risk, and applying enhanced due diligence in high-risk cases.

UK regulated businesses must apply CDD measures for occasional transactions above certain thresholds, or where risk is high.

International / Global Standards

FATF (Financial Action Task Force) Recommendations set out expected practices for due diligence and enhanced due diligence that member jurisdictions must implement.

EU AML Directives require due diligence in customer relationships, particularly or heightened oversight for high-risk customers, third countries, etc.

Types Of Due Diligence & When They Apply

Different levels apply depending on risk and circumstances.

Standard Due Diligence: Default level for most customer relationships; identity verification, basic risk assessment.

Enhanced Due Diligence (EDD): Required when the customer or transaction is high-risk (e.g., PEPs, high-risk jurisdictions, large or complex transactions) or geographic risk factors are present.

Simplified Due Diligence (SDD): In low-risk situations, certain due diligence measures may be reduced or adjusted (but still must satisfy minimum requirements).

Why Due Diligence Matters For AML Compliance

Here are the core reasons due diligence is critical.

Prevent financial crime: By verifying identities and risk, institutions can prevent criminals from using their services.

Regulatory compliance: Laws require due diligence; non-compliance can lead to fines, sanctions, or loss of licence.

Reputation protection: Failing to properly perform due diligence can result in harming trust with customers, partners, regulators.

Risk management: Helps firms understand exposures (geographic, customer segment, product) and allocate resources effectively (e.g. more monitoring where risk is high).

Future Of AML Due Diligence Practices

What we expect to see in due diligence going forward.

Greater automation & technology: Use of AI, machine learning, data analytics to improve risk scoring, anomaly detection, identity verification.

Stronger identity verification tools: Biometrics, digital IDs, cross-border identity verification.

Increased focus on beneficial ownership transparency globally.

Dynamic, real-time monitoring: Rather than static onboarding checks, more continuous oversight.

Regulatory tightening around high risk jurisdictions: More demanding EDD requirements; stricter rules around correspondent banking and transactions involving third countries.

Strengthen Your Due Diligence Compliance Framework

Effective due diligence isn’t optional, it is foundational. To ensure your organisation is protected, your processes for Customer Screening, Watchlist Management, Payment Screening, Transaction Monitoring, and Alert Adjudication must all incorporate robust due diligence steps. Prioritise clarity around risk-levels, document requirements, beneficial ownership, and ongoing monitoring.

Contact Us Today To Strengthen Your AML Compliance Framework

Frequently Asked Questions

What Is The Difference Between Customer Due Diligence And Enhanced Due Diligence?

When Must Financial Institutions Apply Due Diligence Under UK Law?

What Information Is Typically Collected During Due Diligence?

How Should Ongoing Monitoring Be Conducted?

What Are The Consequences Of Inadequate Due Diligence?