Regulatory frameworks are structured systems of laws, rules, guidelines, and supervisory practices that define how organizations must operate to remain compliant with regulatory standards.

In financial services, regulatory frameworks are central to anti-money laundering (AML), counter-terrorist financing (CTF), and financial crime prevention. They establish the obligations institutions must follow for customer due diligence, transaction monitoring, reporting, and governance.

Regulatory Frameworks

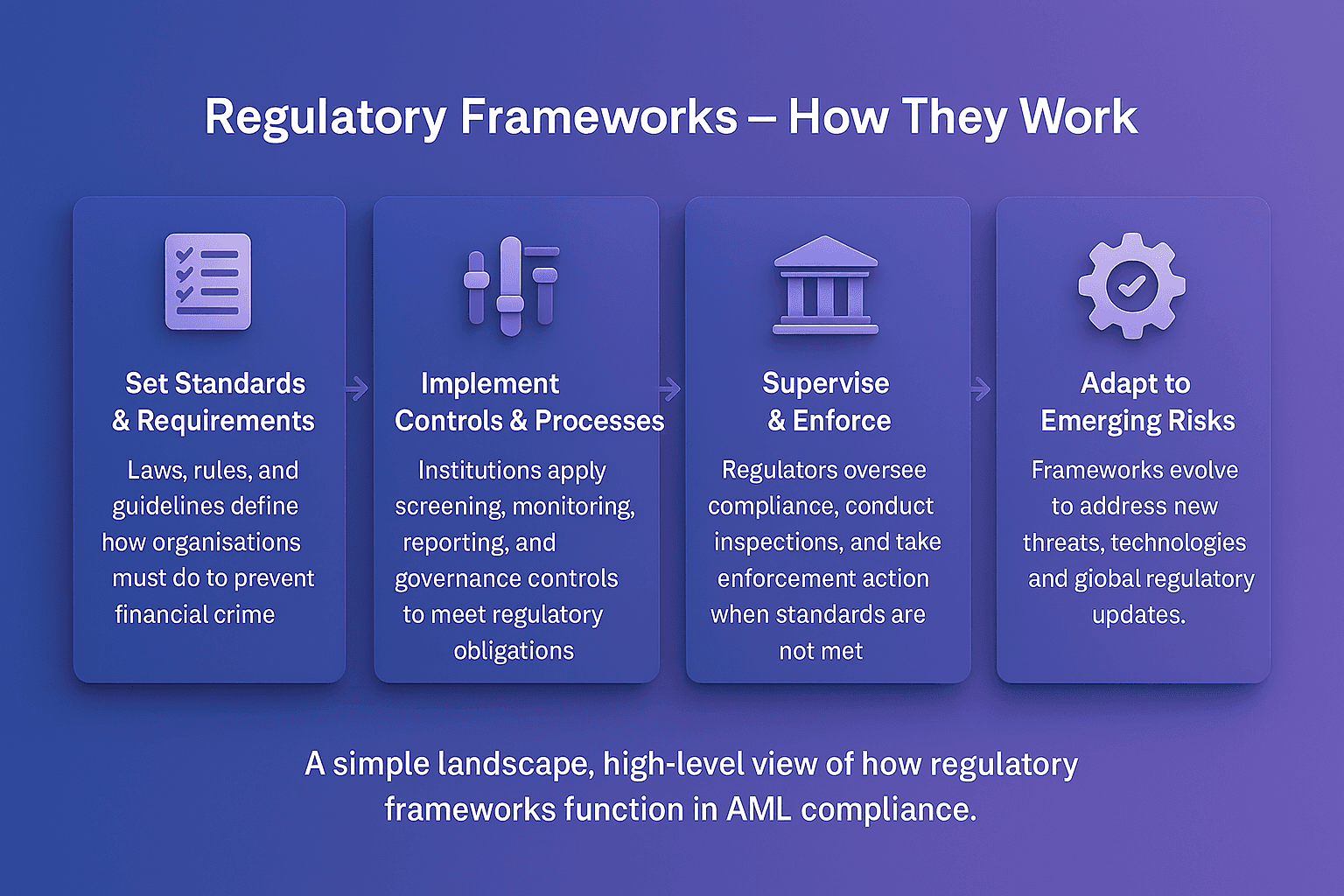

A regulatory framework is the combination of regulatory requirements, enforcement mechanisms, and oversight structures that guide institutions in meeting compliance obligations.

In the AML context, regulatory frameworks typically include:

Customer identification and due diligence requirements

Sanctions screening and watchlist filtering

Suspicious activity reporting (SAR) obligations

Risk-based monitoring and record-keeping

Governance and internal control standards

The Financial Action Task Force (FATF) provides the most influential global regulatory framework through its 40 Recommendations, adopted by over 200 jurisdictions worldwide.

Why Regulatory Frameworks Matter

Regulatory frameworks matter because they ensure consistent financial integrity across markets and prevent criminals from exploiting weak jurisdictions.

The UK Financial Conduct Authority (FCA) mandates that firms establish effective systems and controls to counter financial crime, embedding regulatory frameworks into daily operations.

Without robust regulatory frameworks:

Financial crime risks increase across borders

Firms face higher regulatory fines and enforcement actions

Confidence in financial markets diminishes

Criminals exploit inconsistencies between jurisdictions

Key Examples Of Regulatory Frameworks In AML

Different bodies and jurisdictions create frameworks that set the tone for AML compliance worldwide.

FATF 40 Recommendations

The global standard for AML and CTF compliance, covering customer due diligence, risk-based approaches, record-keeping, and reporting.

EU AML Directives

The European Union’s AMLDs align member states with FATF while expanding rules around beneficial ownership and due diligence.

UK FCA and US FinCEN Standards

National regulators enforce AML frameworks domestically, ensuring institutions implement risk-based controls that meet local obligations.

Regulatory Frameworks In Practice

Financial institutions apply regulatory frameworks by embedding them into internal compliance processes.

This includes:

Customer Screening: Verifying clients against sanctions, PEP, and adverse media lists using tools like FacctView for Customer Screening.

Payment and Transaction Monitoring: Detecting prohibited or unusual activity in real time with solutions such as FacctShield for Payment Screening and FacctGuard for Transaction Monitoring.

Alert Adjudication: Investigating and resolving alerts through platforms like Alert Adjudication.

Watchlist Management: Keeping sanctions and PEP lists updated with FacctList for Watchlist Management.

The Bank for International Settlements (BIS) has highlighted that integrating advanced analytics, especially graph-based machine learning, into regulatory and compliance frameworks can improve detection of illicit activity and reduce inefficiencies.

The Future Of Regulatory Frameworks

Regulatory frameworks are evolving in response to new technologies and emerging financial risks.

Future developments include:

Digital assets regulation: Expanding AML rules to cover cryptocurrencies and blockchain activity.

AI and digital transformation: Regulators like FATF and FCA emphasize AI-driven compliance as part of digital transformation.

Cross-border harmonization: Efforts to align AML laws globally to prevent regulatory arbitrage.

Real-time monitoring standards: Moving away from periodic checks toward continuous, data-driven compliance obligations.

As financial crime becomes increasingly complex, regulatory frameworks will serve as both a compliance mandate and a driver of innovation.

Strengthen Your Regulatory Frameworks

Regulatory frameworks are essential for safeguarding financial integrity. By embedding effective frameworks supported by technology, institutions can comply with regulations, prevent financial crime, and build market trust.

Contact Us Today To Strengthen Your AML Compliance Framework