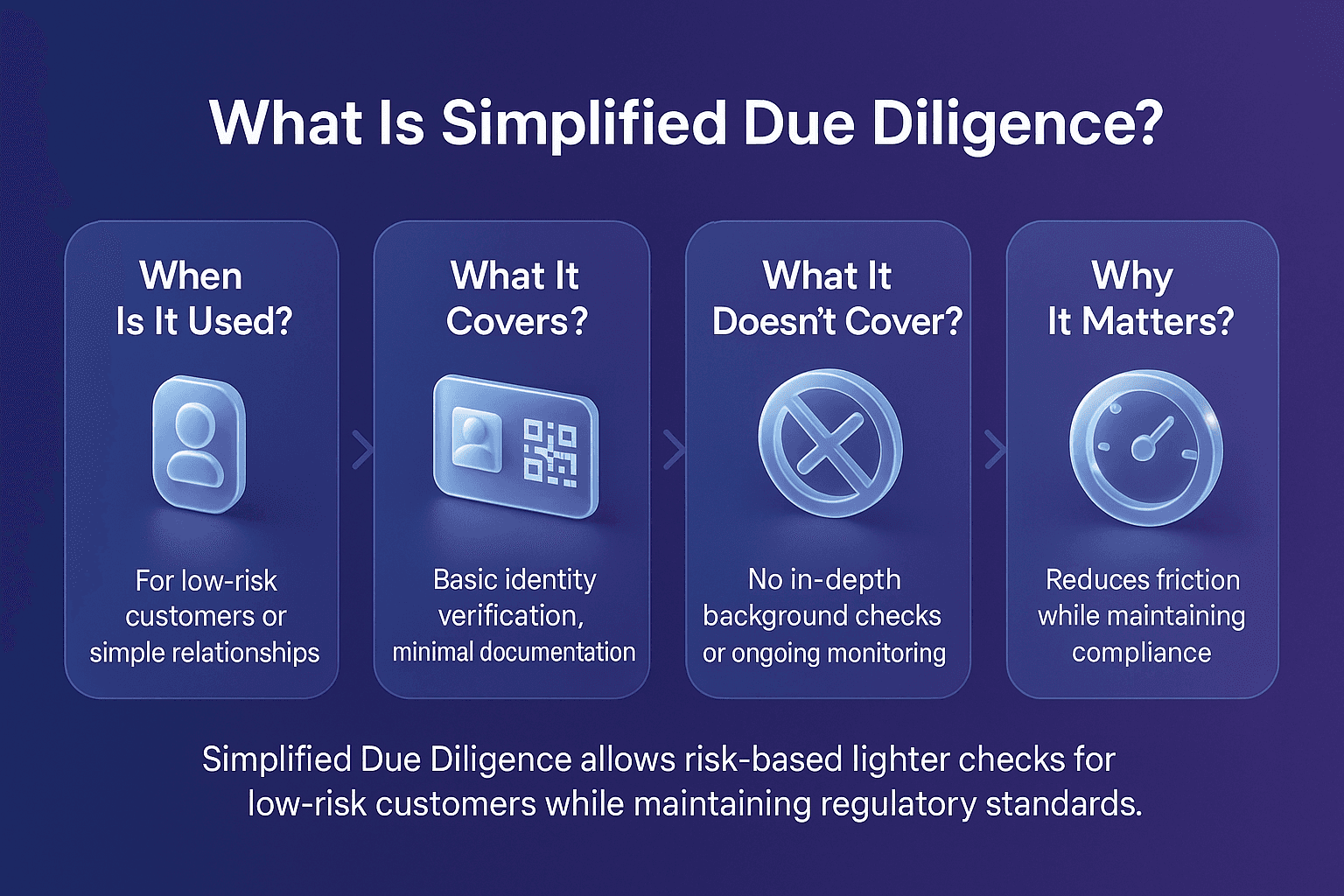

Simplified Due Diligence (SDD) is a form of customer due diligence applied to low-risk clients and transactions under AML regulations. Unlike standard or enhanced due diligence (EDD), SDD reduces the scope of identity verification and monitoring because the likelihood of financial crime is considered minimal.

While SDD reduces the burden on institutions and customers, regulators emphasise that it must be applied cautiously and only where risk assessments justify its use.

Simplified Due Diligence (SDD)

SDD is a streamlined compliance process that allows financial institutions to apply lighter verification and monitoring measures in specific low-risk scenarios.

Typical features of SDD include:

Relying on fewer or less detailed identity documents.

Reduced frequency of ongoing monitoring.

Fewer requirements for documenting beneficial ownership.

The Financial Action Task Force (FATF) permits simplified due diligence (SDD) where risks are demonstrably low, but emphasizes that SDD should not be applied automatically. Firms must assess risk and apply enhanced or standard due diligence when risk increases. For example, FATF’s “Guidance on Financial Inclusion and AML/CFT Measures” states that risk assessments enable institutions to apply simplified measures in low-risk cases

When Can Simplified Due Diligence Be Applied?

SDD can be applied when a risk assessment determines that a customer, product, or transaction poses a low risk of money laundering or terrorist financing.

Examples include:

Accounts with strict caps on transactions and balances.

Certain government entities or publicly listed companies subject to strong disclosure rules.

Low-value insurance products with minimal money laundering risk.

In the EU, the European Banking Authority (EBA) provides guidelines under its ML/TF Risk Factors framework that outline risk factors for products, services, customers, and channels, and explicitly permit Simplified Due Diligence (SDD) in cases where a business relationship or transaction presents a low degree of risk (as per Article 33 of the AML Regulation).

Why Simplified Due Diligence Matters In Compliance

SDD matters because it allows institutions to focus resources where risks are highest, consistent with the risk-based approach.

Efficiency: SDD reduces compliance costs by avoiding unnecessary checks for low-risk customers.

Customer experience: SDD simplifies onboarding, reducing friction in low-risk relationships.

Proportionality: Regulators such as FATF and the European Commission encourage proportional compliance measures that balance efficiency with risk management. The latest FATF updates explicitly call for implementation of controls that are proportionate to identified risk, and for simplified or lighter measures where risk is lower. Meanwhile, the EU Commission’s AML policies require additional due diligence for business relationships involving high-risk third countries, reflecting that measures scale with risk.

At the same time, inappropriate use of SDD can expose institutions to regulatory penalties if risks are underestimated.

SDD vs Standard and Enhanced Due Diligence

Simplified Due Diligence

Applied only where risk is low, with reduced verification and monitoring requirements.

Standard Due Diligence

The default level of customer due diligence, requiring verification of identity, beneficial ownership, and ongoing monitoring.

Enhanced Due Diligence

Applied in high-risk scenarios, such as politically exposed persons (PEPs) or high-risk jurisdictions, requiring additional checks and ongoing scrutiny.

These levels of due diligence ensure that compliance frameworks are risk-based and proportionate.

The Future Of Simplified Due Diligence

The role of SDD will evolve as technology and regulation advance.

Data-driven risk assessment: AI and advanced analytics will make it easier to justify and document SDD decisions.

Harmonisation: The EU’s AMLA and Single Rulebook (Regulation (EU) 2024/1624), together with the AMLR framework, clarify when and how Simplified Due Diligence (SDD) can be applied consistently across Member States. For example, Article 33 of the AMLR permits obliged entities to apply SDD in business relationships or transactions that present a low degree of risk under harmonised criteria.

Dynamic reassessment: Real-time Customer Screening and Transaction Monitoring will ensure that customers initially classified as low-risk are reassessed if behaviour changes.

Institutions that misuse SDD face regulatory action, but those that apply it correctly improve efficiency and compliance outcomes.

Strengthen Your Due Diligence Compliance Framework

Simplified due diligence can make compliance more efficient, but only when applied with care and supported by strong monitoring. Institutions must balance efficiency with vigilance to meet regulatory expectations.

Facctum’s Customer Screening and Transaction Monitoring solutions enable institutions to apply SDD safely within a robust, risk-based compliance framework.

Contact Us Today To Strengthen Your AML Compliance Framework